Demystifying the 'Development Universe'

August 2016

I recently attended a webinar on 'Careers in Impact' conducted by my alma mater, wherein people in the development sector talked about taking the 'road less travelled', work and interacting with different stakeholders. Having been a part of this sector (my first job was with the World Bank) and having faced all kinds of queries (including, and I am not joking, how to open an account at World Bank!) it was heartening to see the high level of interest in this sector. Excepts from the webinar - interesting perspectives shared by a panelist, Srikrishna S, Co-founder and CEO of Sattva:

1. Bunker Roy remarked that the driving force behind many iconic movements during 1970-80's was anger, and not passion. The key question was "What issues and problems do you see around you that make you angry and pursue it and tackle it full time?"

2. The Head-Heart-Hands equation: The decision to join social sector should be a perfect balance of ability to solve complex problems (head), proper execution game plan (hand) and passion to make a difference (heart).

3. Now is the best time to be in the development sector: Venture philanthropy and impact investing have taken off in a big way; the new Corporate Social Responsibility (CSR) rules that mandate companies with sizable businesses to spend a minimum of 2 percent of net profit for benefit of society are leading to investments and renewed interest in this sector.

As I started discussing these aspects with family and friends, I realised that not a day goes by without a news article or blog post talking about the plethora of words in the development universe - catalytic philanthropy, impact investment fund, charities, non profit organisations, global development organisations, social enterprise et al. I am sure all of us read these articles with different degrees of interest, but I believe that everyone is interested in understanding the use of resources (financial & otherwise) and business principles for public good. And the starting point for better understanding is a simple classification of development organisations; and here is my attempt at demystifying the 'development universe':

1. The International Classification of Nonprofit Organisations (ICNPO):

ICNPO is a classification system of non profit organisations (characteristic features being organised, private, self governing, non-profit-distributing, voluntary). This classification system is based on the activity undertaken, and the 12 groups are Culture and Recreation; Education and Research; Health; Social Services; Environment; Development and Housing; Law, Advocacy and Politics; Philanthropic intermediaries and Voluntarism promotion; International; Religion; Business and Professional associations, Unions; Not elsewhere classified - further divided into sub groups. Further details can be accessed here. Source: Salamon et al (1996), Working papers of the John Hopkins Comparitive Nonprofit Sector Project, The John Hopkins Institute for Policy Studies.

The above classification system facilitates systemic comparison across countries and is a useful analytical tool. I continued my search for more recent articles showing inter-relationships between key parameters, and I found the 'involvement profit matrix'.

2. The involvement profit matrix:

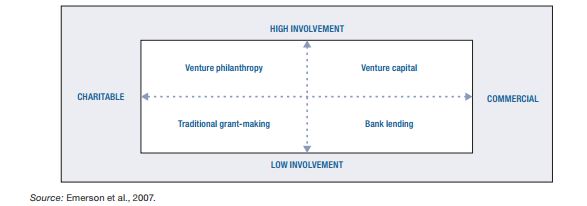

Emerson et al (2007) plot venture philanthropy and venture capital in the broader landscape of investment and engagement.

Fig 1: The involvement profit matrix

The above graph superbly illustrates the differences between traditional grants, bank lending, venture capital and venture philanthropy using two key parameters - level of involvement (high vs low) and purpose of the investment (charitable vs commercial). Thus, traditional grants can be understood as investments made for a charitable purpose with a low degree of involvement by the investor; whereas an investment with low involvement but for earning a financial return is termed bank lending. Venture capital refers to deployment of capital by the investor for the purpose of earning financial return, along with non-financial resources and tools for risk management, performance management et al; on the other hand, venture philanthropy would signal high degree of involvement aka using venture capitalist tools for making a social impact.

The phrase venture philanthropy was coined by John D Rockefeller III in 1969 who stated that "Venture philanthropy is an adventurous approach to funding unpopular social causes". Keeping abreast with the evolving definition of venture philanthropy, an Organisation for Economic Cooperation and Development (OECD) report "Venture Philanthropy in Development" defines it thus: "Venture philanthropy is an entrepreneurial and cross-sector approach to

philanthropy that combines a variety of financial and non-financial resources

to identify, analyse, co-ordinate and support self-sustaining, systemic and

scalable solutions to development challenges for greatest impact".

3. Impact and institution framework:

European Venture Philanthropy Association (EVPA) highlights the broadening range of flexible finance options with "blended societal and financial value" (detailed analysis in the 90 page OECD report). Taking this one step further, my aim is to plot the impact and insititution framework - the impact axis indicating the movement from societal impact to financial impact across the complex evolving institutional landscape of Multilateral institutions, International NGOs, Government agencies and

Private organisations). For easy understanding, I have listed a few examples against each one.

1. Multilateral/ International institutions: These are intergovernmental organisations; international financial institutions working towards international development, whose members are nations or other intergovernmental organisations. United Nations, World bank group, International Monetary Fund (IMF) are examples of multilateral organisations.

2. International NGOs: International Non Governmental Organisations are independent and distinct from government or intergovernmental organisations. These NGOs are involved in delivering aid and implementing programs across countries and areas (health, children, women, specific communities et al). Important players include CARE, Medicins Sans Frontiers (MSF), Save the Children, BRAC et al.

3. Government agencies: National departments/ agencies are part of the government machinery for administering aid and funding development projects. Notable agencies include Department of International Development (DfID - UK); United States Agency for International Development (USAID - USA); International Development Research Centre (IDRC - Canada) et al.

4. Non profit and non governmental organisations operating at a national or local scale: There are a lot of organisations that are private, non profit distributing and employing full time staff as well as volunteers, that are engaged directly with specific communities or working for specific causes.

5. Private foundations: These are non profit organisations generally created by an individual, family or group of individuals for philanthropic purpose. The Bill and Melinda Gates Foundation (BMGF), Rockefeller foundation, Shell foundation are some of the largest foundations.

6. Impact investors: Simply put, impact investing refers to investments made with the intention of generating societal impact along with a financial return. This movement along the impact axis indicates the shift from non profit organisations. Private equity company Norwegian Norfund is one such example.

7. Social enterprises: A social enterprise is an organisation that applies commercial strategies to maximize social impact along with profits for stakeholders. Depending on the country, they could be structured as non profit entities as well.

8. Consulting firms: To be honest, I plotted consulting firms under the bucket 'societal and financial' as I was concentrating on the consulting firms that specialise in international development and work alongside NGOs, multilateral organisations and businesses for CSR. However, I do realise that the top consulting firms have separate divisions focused on sustainable development and emerging economies.

9. Corporations involved in philanthropy and CSR: Even before the advent of the CSR regime, top corporates like Johnson and Johnson, Microsoft, Exxon have been involved in philanthropy in a huge way; and more and more businesses are being added to the list.

This landscape is continuously evolving and there is considerable difficulty in plotting options under concise buckets or drawing strict boundaries. I have been fortunate to get the opportunity of working with quite a few organisations mentioned above, and hopefully my attempt at explaining this ever expanding universe serves as a platform for further learning and discussions.

European Venture Philanthropy Association (EVPA) highlights the broadening range of flexible finance options with "blended societal and financial value" (detailed analysis in the 90 page OECD report). Taking this one step further, my aim is to plot the impact and insititution framework - the impact axis indicating the movement from societal impact to financial impact across the complex evolving institutional landscape of Multilateral institutions, International NGOs, Government agencies and

Private organisations). For easy understanding, I have listed a few examples against each one.

Fig 2: Impact and institution framework

(Source: Author's framework)

1. Multilateral/ International institutions: These are intergovernmental organisations; international financial institutions working towards international development, whose members are nations or other intergovernmental organisations. United Nations, World bank group, International Monetary Fund (IMF) are examples of multilateral organisations.

2. International NGOs: International Non Governmental Organisations are independent and distinct from government or intergovernmental organisations. These NGOs are involved in delivering aid and implementing programs across countries and areas (health, children, women, specific communities et al). Important players include CARE, Medicins Sans Frontiers (MSF), Save the Children, BRAC et al.

3. Government agencies: National departments/ agencies are part of the government machinery for administering aid and funding development projects. Notable agencies include Department of International Development (DfID - UK); United States Agency for International Development (USAID - USA); International Development Research Centre (IDRC - Canada) et al.

4. Non profit and non governmental organisations operating at a national or local scale: There are a lot of organisations that are private, non profit distributing and employing full time staff as well as volunteers, that are engaged directly with specific communities or working for specific causes.

5. Private foundations: These are non profit organisations generally created by an individual, family or group of individuals for philanthropic purpose. The Bill and Melinda Gates Foundation (BMGF), Rockefeller foundation, Shell foundation are some of the largest foundations.

6. Impact investors: Simply put, impact investing refers to investments made with the intention of generating societal impact along with a financial return. This movement along the impact axis indicates the shift from non profit organisations. Private equity company Norwegian Norfund is one such example.

7. Social enterprises: A social enterprise is an organisation that applies commercial strategies to maximize social impact along with profits for stakeholders. Depending on the country, they could be structured as non profit entities as well.

8. Consulting firms: To be honest, I plotted consulting firms under the bucket 'societal and financial' as I was concentrating on the consulting firms that specialise in international development and work alongside NGOs, multilateral organisations and businesses for CSR. However, I do realise that the top consulting firms have separate divisions focused on sustainable development and emerging economies.

9. Corporations involved in philanthropy and CSR: Even before the advent of the CSR regime, top corporates like Johnson and Johnson, Microsoft, Exxon have been involved in philanthropy in a huge way; and more and more businesses are being added to the list.

This landscape is continuously evolving and there is considerable difficulty in plotting options under concise buckets or drawing strict boundaries. I have been fortunate to get the opportunity of working with quite a few organisations mentioned above, and hopefully my attempt at explaining this ever expanding universe serves as a platform for further learning and discussions.

Comments

Post a Comment